Here at First Choice Finance our wealth of knowledge and 25 years experience in the mortgage and loan sector can provide you with the guidance and tricks of the trade of how to improve your credit score based on what we know our lenders are looking for. Read on to find out more. If you want to see without obligation what finance deals are available to you now, with your credit score as it stands, we can provide you with our options and free quotes to go along with them. Call us on 0800 298 3000 (landline) or 0333 003 1505 (mobile friendly), you can also complete our short on line enquiry form. We will not do a credit search from this form either, as this is one element that can impact on your credit score.

Here at First Choice Finance our wealth of knowledge and 25 years experience in the mortgage and loan sector can provide you with the guidance and tricks of the trade of how to improve your credit score based on what we know our lenders are looking for. Read on to find out more. If you want to see without obligation what finance deals are available to you now, with your credit score as it stands, we can provide you with our options and free quotes to go along with them. Call us on 0800 298 3000 (landline) or 0333 003 1505 (mobile friendly), you can also complete our short on line enquiry form. We will not do a credit search from this form either, as this is one element that can impact on your credit score.Keep Up With Your Repayments

This may seem like an obvious point but the most important thing when considering how to improve your credit score is to keep up with the current payments you have going out of your bank, ensuring that they are paid in full and on time. Whilst lenders understand that we don`t all have a perfect credit report; in fact a good credit score can be something different for every lender, they need to see the evidence that you can make repayments. Areas of missed or late payments may give the impression that you have previously been unable to cope with your existing credit. If you think you are getting to the stage where you are struggling to make your repayments you need to take action now before your credit report is damaged. Refinancing can take you back to a level where your payments are manageable and can even reduce your outgoings, for information on how you might be able to do this contact us on the above number to speak to a finance adviser.

This may seem like an obvious point but the most important thing when considering how to improve your credit score is to keep up with the current payments you have going out of your bank, ensuring that they are paid in full and on time. Whilst lenders understand that we don`t all have a perfect credit report; in fact a good credit score can be something different for every lender, they need to see the evidence that you can make repayments. Areas of missed or late payments may give the impression that you have previously been unable to cope with your existing credit. If you think you are getting to the stage where you are struggling to make your repayments you need to take action now before your credit report is damaged. Refinancing can take you back to a level where your payments are manageable and can even reduce your outgoings, for information on how you might be able to do this contact us on the above number to speak to a finance adviser.Check Your Credit Report

Before you know how to improve your credit score, you need to know what you are dealing with. When you have that information you can focus on the fundamental ways to start repairing it. We can provide you with a link to one of the leading credit reference agencies to get a full credit report done for a small one off fee of £2.00 ( we DO NOT receive any commission for this). Once you have your report you can take a look at it to establish the areas that you need to build upon with regards to your credit score, you can even send a copy of it across to ourselves to have an expert adviser explain it to you.Many people are often surprised to find that even with what they feel is bad credit, we can still find a way to raise them the finance they need. The best way to find out is to simply call us free on 0800 298 3000 from a landline or our mobile friendly number on 0333 003 1505 to speak to an understanding adviser.

Building Manageable Credit

If you have applied and subsequently been rejected for a mortgage you might be asking yourself, why was my mortgage application rejected? One of the possible reasons could simply be because you have no other credit. Whilst you may have been told that having any kind of debt outstanding is a bad thing this isn`t strictly true. Having a small existing credit card for example, can evidence to a future lender that you already have managed to keep up your repayments in the past and this history can encourage them to look at your application as a positive one, increasing your chance of an accept. Fortunately, if you are in this situation it doesn`t necessarily mean that a mortgage application would be rejected, by coming to an experienced mortgage broker like ourselves it could increase your chance of an accept, fill in the 1 minute online application form at the top of the page and we can get back to you.Bad Credit Remortgages and Loans

Let us help you clean up your credit report for good. A remortgage now can set you on the right path for the future by allowing you to repay all of those debts that may have been getting on top of you. By combining them into one easy and manageable payment you only have to make the one payment each month, reducing the chance of you missing any further payments and damaging your credit score further. To add to that if you manage to make all of your payments in full and on time it will often help to improve your credit score and could possibly give you access to mortgage plans for good credit, if you choose to remortgage in the future. Loans are available too from a few thousand pounds up to one hundred thousand pounds for virtually any purpose. Of course our team of finance advisers can give you may more details, provide you with free quotes and also tips of how to improve your credit score. To find out more call us on 0800 298 3000 (landline) 0333 003 1505 (mobile friendly) or fill in the form starting at the top right of this page.

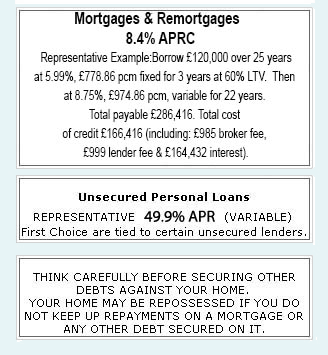

|

|

Unsecured Personal Loans |

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST

YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential